METHODS TO GIVE

ONLINE GIVING

Click the image above to create an account or sign into your existing one, and you can start managing your online giving.

KIOSK GIVING

Giving is safe and secure providing another way for you to support the ministries at Calvary Houston.

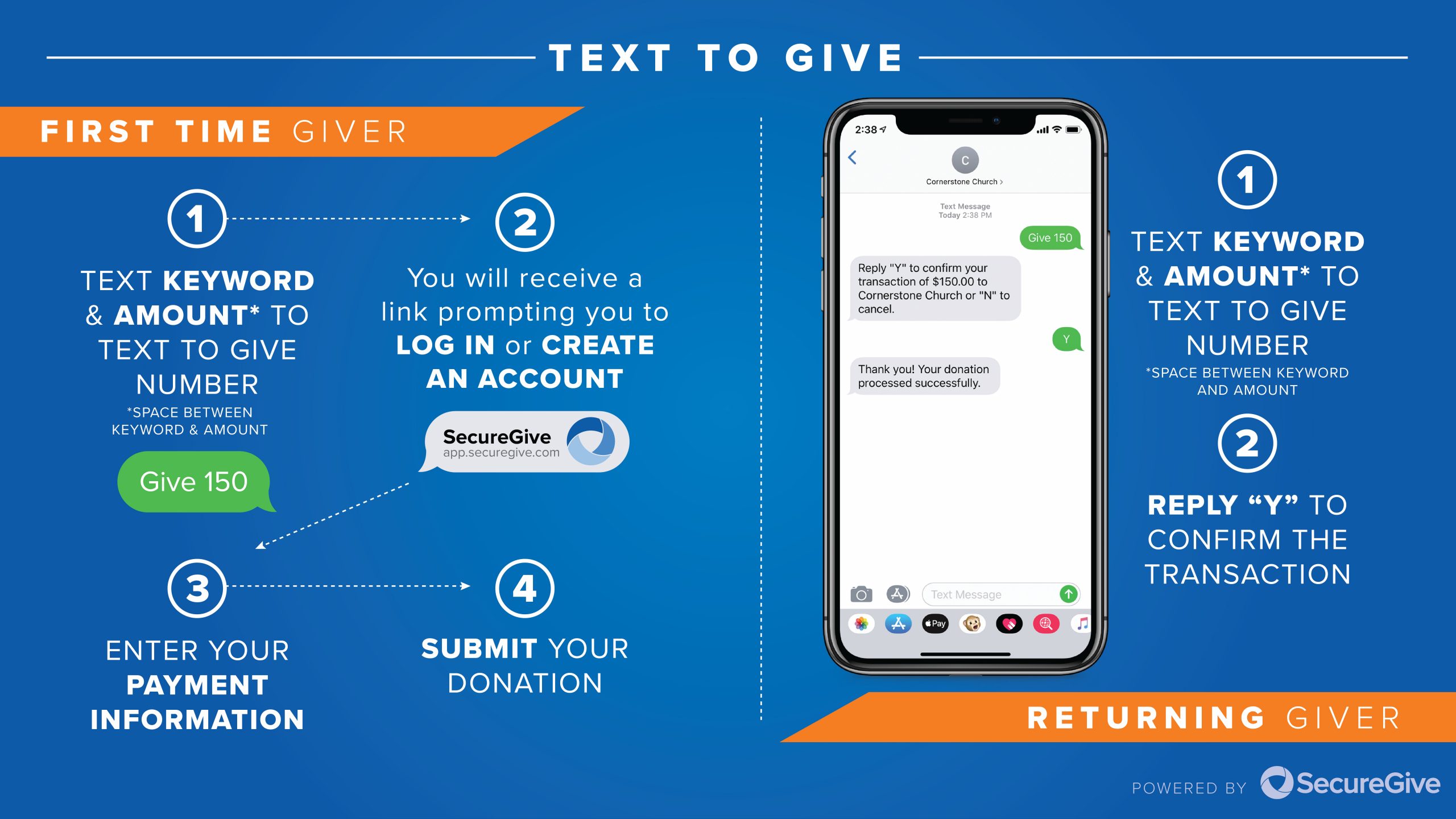

TEXT TO GIVE

Give a gift through simple text messages. Simply text the keyword “

For example, text “

After saving your account information (first time only), you will be asked to confirm the amount. That’s it!

CASH & CHECKS

You can always give to Calvary Houston by cash or check. Although we do not take an offering during services, we believe that God has called every believer to support the work of the ministry at their home church by giving tithes and offerings regularly.

Offering boxes are located by the exit doors of the Main Sanctuary and Lobby, or you can mail your gift to:

Calvary Houston

3700 E FM 528 Rd.

Friendswood, TX 77546

ADDTIONAL OPPORTUNTIES TO GIVE

Tax-Smart Giving Today

Donor-advised fund (“DAF”) is especially useful if you have stocks, mutual funds, or properties that have appreciated in value, and you can get an immediate tax deduction for future giving.

Qualified Charitable Distribution (“QCD”) is an opportunity for people who are over 70-1/2 and who have a traditional IRA, to gift a qualified charitable distribution tax-free.

Donor-advised fund (“DAF”)

Give. When you contribute to a DAF, you’re eligible for an immediate tax deduction.

Grow. Your contribution is also invested based on your preferences, so it has the potential to grow tax-free.

Grant. Because a Giving Account is a donor-advised fund, you advise on granting the money out to your favorite charities.

Qualified Charitable Distribution (“QCD”)

Starting at age 70½, a QCD is a direct transfer of money from your IRA provider, payable to a qualified charity.

QCDs can be counted toward satisfying your required minimum distributions (RMDs) for the year.

The distribution is not counted as income on your taxes, as long as certain rules are met.

Future Impact (Legacy) Giving

Options can include an estate gift from a Will or Trust, a Beneficiary designation for an account such as a IRA, Life insurance proceeds. These various instruments can ensure that your intentions are faithfully carried out after you pass.

There are other options that give you income now, with instructions to be carried out after you pass. Some examples are a Charitable Gift Annuity or Charitable Remainder Trust.

What is the Difference and the Impact?

Wills or Trusts: Gives clear instructions for distributing assets and can reduce possibility family tensions, as well as expenses to your estate.

Beneficiary or Life Insurance: These specifically name the recipient of assets so that your intentions are carried out.

Charitable Trusts: A Charitable Gift Annuity or a Charitable Remainder Trust can give you income now, with instructions for the assets after you pass.

Eternal Impact: If you choose to gift a portion of your assets to Calvary Houston, you will leave a legacy used to further the gospel of Jesus Christ.

Shopping

Do you shop at Kroger? If so, you can sign up online at Kroger Community Rewards, set Calvary Houston as your charity, and a percentage of your purchases will be donated to your home church.

It’s simple to set up. Sign up for Kroger Community Rewards and let your shopping make a difference!

Thank you for your prayerful consideration in giving to the Lord at Calvary Houston. Your tithes and offerings are supporting the ministries here at Calvary, as well as other local, national, and international outreaches and missions we support.

Calvary Houston is faithfully committed to good stewardship and integrity in the management of the resources God provides.

FREQUENTLY ASKED QUESTIONS

WHAT TYPES OF BANK ACCOUNTS CAN I GIVE FROM?

You can give online from your checking account or from these credit card providers: MasterCard, Visa, or American Express.

ARE THERE ANY FEES INVOLVED WITH GIVING ONLINE?

You do not have to pay any fees with an online gift, however, you can choose to cover the credit card fees at the time you give. Of course, this is completely up to you! In addition, online gifts are a more cost efficient way for the church to process donations. Using your debit card is best since our fees are considerably lower.

CAN I MAKE A ONE-TIME OR RECURRING CONTRIBUTION?

Yes. You have the option of either making a one-time gift or setting up a recurring gift. For a one-time gift, you can designate if the gift should be made immediately or you can schedule the gift to come out of your bank account on the date(s) specified by you. Likewise, reccurring gifts can be scheduled on the dates that work best for you.

CAN I CHANGE MY PERSONAL INFORMATION, AMOUNT OR FREQUENCY OF MY GIFT ONCE I HAVE SET IT UP?

Yes. You can change or cancel your contribution at any time before the date of your next contribution. Simply log in using your user name and password to make the necessary changes.

CAN I REVIEW MY DONATION HISTORY ONLINE?

Yes. You are able view the complete history of your contributions. If you have a CALVARY CONNECT account, your giving history will be there too.

WILL I STILL RECEIVE REGULAR CONTRIBUTION STATEMENTS FROM THE CHURCH?

Calvary Houston will provide online access to year-end contribution statements. At your request, we can send a giving statement to your address on file for tax purposes.